Before joining the team, I had spent several years running affiliate programs in B2C verticals, primarily in the home improvement and clean energy space. That work involved packaging offers, working with affiliate networks, managing traffic quality, and dealing with the trade-offs between scale, control, and downstream performance.

When I joined this company, affiliate marketing was still an early-stage channel. There was already an affiliate manager with good experience in e-commerce and aggregator partnerships, so the discussion was never about whether affiliate marketing could work. The real question was how to adapt a performance-driven model into a B2B fintech environment without creating compliance risks, data issues, or operational noise.

My role was to take what I had learned from B2C affiliate programs and turn it into something that could actually run inside this business.

Building the Foundation First

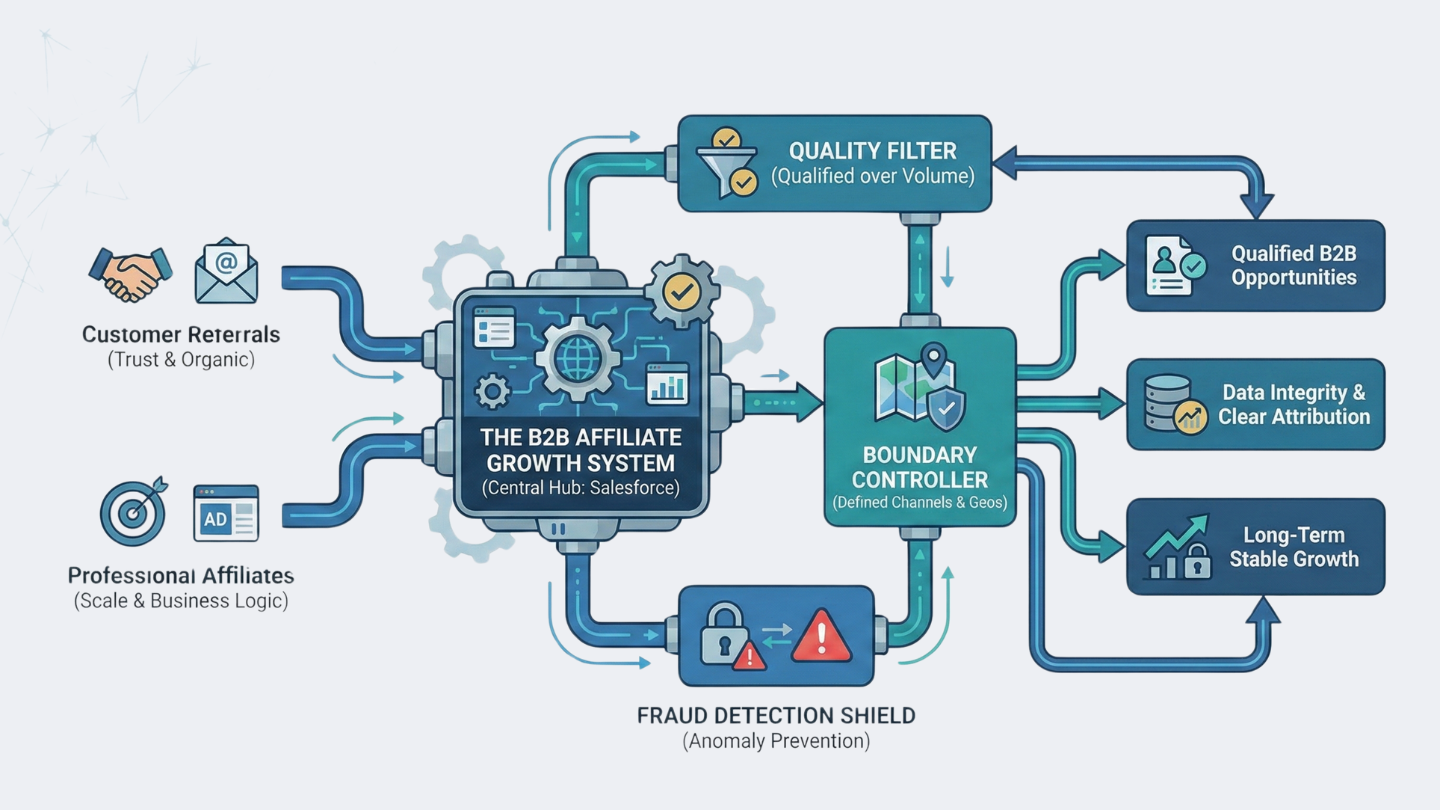

The first thing I focused on was infrastructure. We standardized the entire affiliate setup using HasOffers (HasOffers is now TUNE) so tracking, attribution, and payouts all lived in one place. That decision alone removed a lot of ambiguity later, especially once multiple acquisition paths started running in parallel.

From there, we intentionally tested two approaches at the same time. One was running affiliates directly through our internal affiliate manager, where we had tighter control but higher operational cost. The other was working with affiliate networks, where we repackaged the product as a clear offer and distributed it more broadly, accepting revenue share and less transparency in exchange for speed and reach.

Running both paths in parallel helped us understand the trade-offs early instead of locking ourselves into a single model too soon.

Setting Constraints Before Scaling

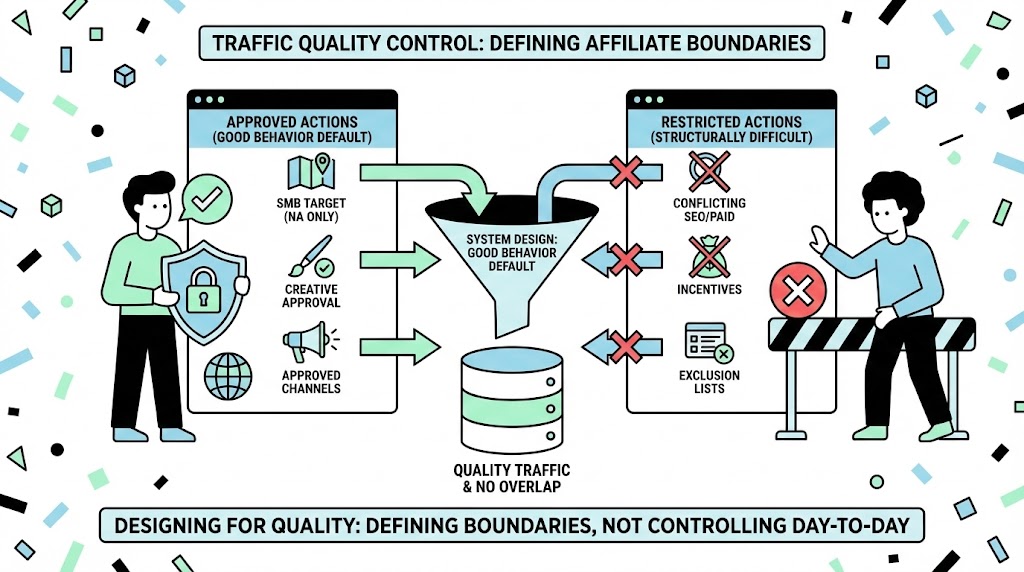

One lesson I carried over from B2C affiliate work was that traffic quality problems always become an issue. Because of that, we spent time upfront defining what affiliates could and could not do. We restricted incentives, SEO, and paid search activity that might conflict with existing campaigns. We limited the program to North American SMBs and required creative approval before anything went live. We also maintained exclusion lists to avoid overlap with internal marketing efforts and existing customers.

The intention was never to control affiliates day by day. The goal was to design a system where good behavior was the default and bad behavior was structurally difficult.

Separating Referrals From Professional Affiliates

Another important decision was separating customer referrals from professional affiliates referrals.

Customer referrals were treated as a product feature. Customers could generate a referral link and share it naturally through their own relationships. Volumes were limited by design, incentives were modest, and trust was the primary driver.

Professional affiliates worked very differently. They evaluated offers based on economics, attribution accuracy, and payout reliability. When those pieces worked, they could scale quickly. That scalability was valuable, but only if tracking and expectations were clear from the beginning. Treating these two groups as the same channel would have created confusion, so we designed and measured them separately.

Validating Quality Before Optimizing Payouts

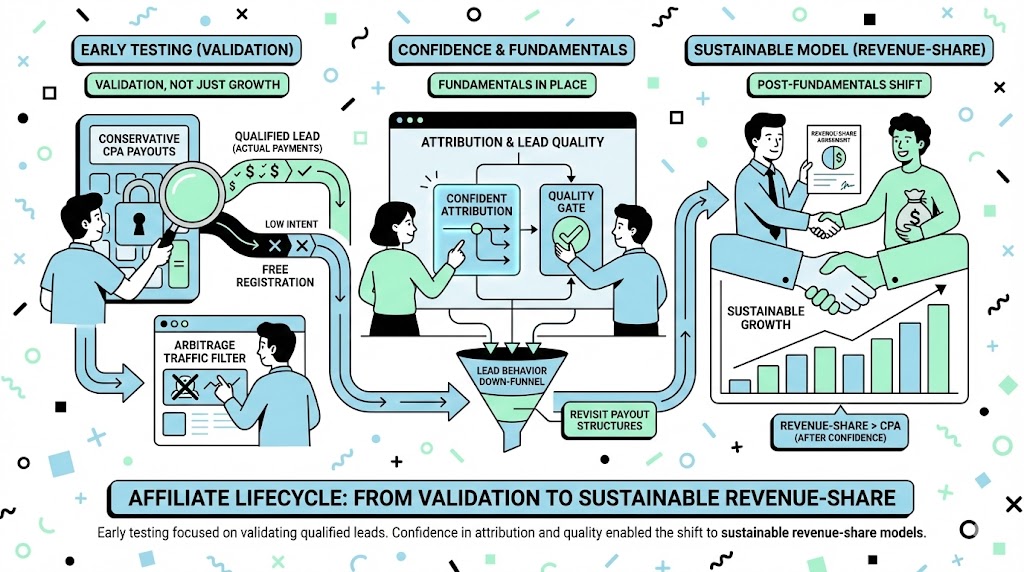

During early testing, payouts were intentionally conservative on CPA for new affiliates. The objective was not growth for its own sake, but validation.

We wanted to see which affiliates could deliver qualified customers with actual payments rather than just free registrations, how those leads behaved further down the funnel, and where low-intent or arbitrage traffic might appear. Only after we had confidence in attribution and lead quality did it make sense to revisit payout structures. Over time, revenue-share models proved more sustainable than pure CPA, but that shift came after the fundamentals were already in place.

Making Attribution Work Inside the CRM

We also need new customer remain traceable after it enters the CRM.

In our case, Salesforce became the system of record. I designed custom fields and automated flows so every inbound lead carried clear source information, including whether it came from an affiliate, a specific affiliate network, or a customer referral. Each lead was tied back to a unique tracking identifier from HasOffers, which made reporting and performance analysis reliable instead of speculative.

This structure also helped keep affiliate growth separate from partner-led growth, which followed a longer-term relationship model and required different metrics and expectations.

What Actually Mattered in the End

Looking back, the most important part of this project was not launching an affiliate program. It was defining what kind of affiliate growth the business could support.

We chose to prioritize traffic quality, clean attribution, and operational clarity over short-term volume. That meant limiting scope, saying no to certain models, and accepting slower early growth. The trade-off was a channel that could scale without breaking trust, data integrity, or internal processes.

Affiliate growth can work in B2B fintech, but only when it is treated as a system and not a shortcut.