Email is one of those channels that everyone assumes is simple until they actually try to scale it. On paper it looks straightforward: write a good message, send it at the right time, measure the opens and clicks. But once you start dealing with onboarding, lifecycle flows, compliance rules, CRM sync issues, and the many creative opinions floating around a company, you realize email is basically a miniature infrastructure project disguised as “marketing.”

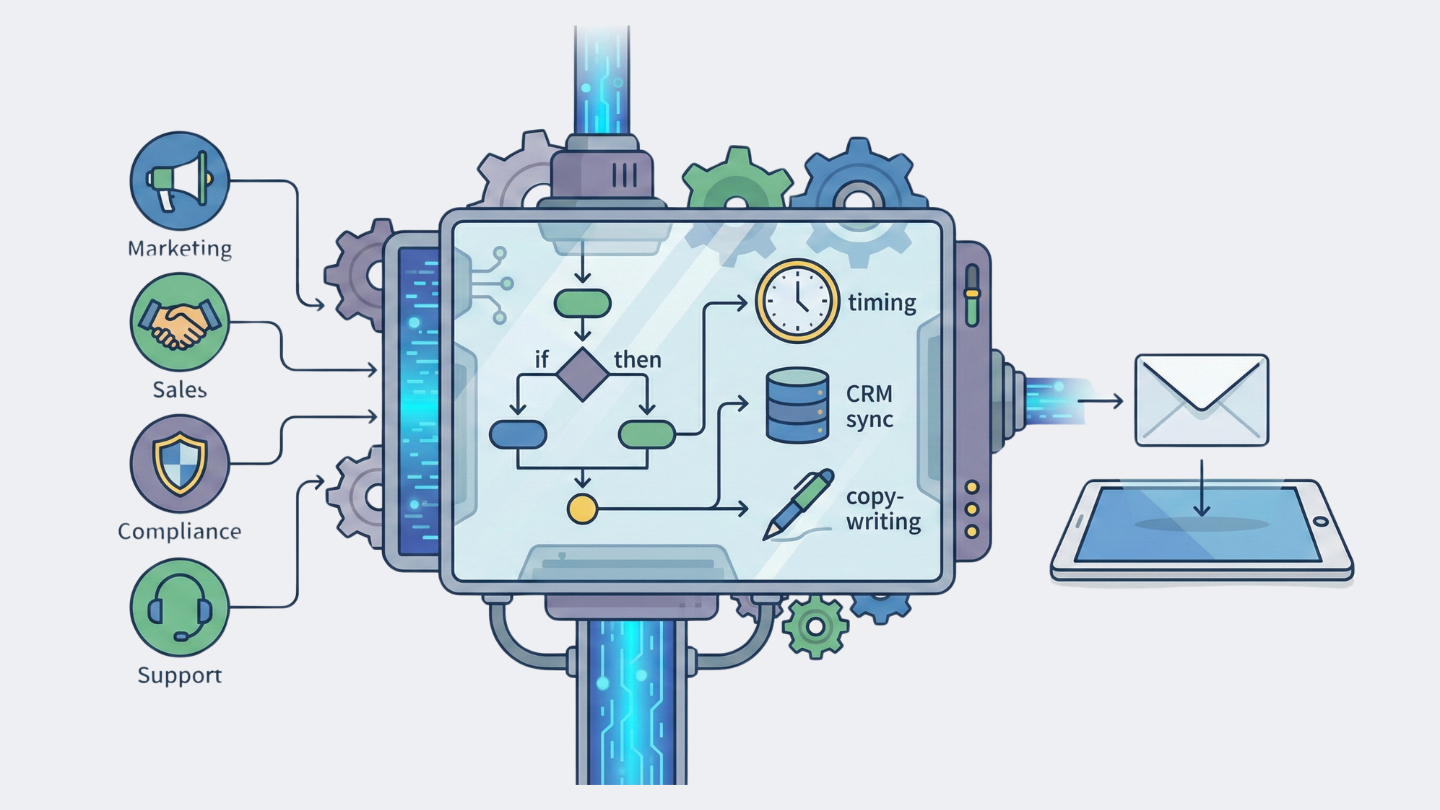

When I look back at the email work I’ve done, the part that stands out isn’t the writing or the design, it’s the systems thinking. It starts with understanding what the customer is actually trying to do at that their stage, and what internal teams need from that moment. Marketing wants engagement signals; sales wants clarity; compliance wants accurate disclosures and correct documents; customer support wants fewer confused users clogging the inbox. A good email isn’t a broadcast. It’s a negotiation between all of these realities.

One thing I’ve learned is that timing, not creativity, usually makes or breaks email effectiveness. You can write the most beautifully structured message, but if it lands at the wrong moment in the user’s workflow, it becomes noise. In fintech this is even more obvious. A user who just registered doesn’t care about product announcements. Someone stuck during KYC doesn’t want a discount. A customer who finally completed onboarding is in a very different emotional state from someone who abandoned halfway because they didn’t understand a document requirement. Email works only when it aligns with these micro-moments.

The operational side matters just as much. Whenever I design a sequence, I’m really designing a decision tree: if the user does X, show them Y; if they don’t, help them get unstuck. The more the system understands state changes, the fewer emails you need. That’s why I always prioritize data infrastructure before content. A clean lifecycle structure — even a simple one — lets you be more confident about what to say, because the segmentation already did half the work.

Copywriting for email in fintech is also its own art. You don’t have the luxury of long explanations; you’re meeting users in a crowded inbox, usually during a task they already feel anxious about. I try to write emails the same way a knowledgeable colleague would talk: short enough to digest, clear enough to act on, and respectful enough not to assume technical understanding. The goal isn’t persuasion — it’s movement. If the reader knows exactly what to do next after reading your email, you’ve already won.

Testing also plays a much bigger role than people think. Sometimes a subject line that looks boring on paper performs better because it reduces uncertainty. Sometimes a CTA that feels too direct ends up helping overwhelmed users. There were times when simply changing the order of two sentences increased completion rates because it made the path more obvious. Email is full of these tiny, unglamorous optimizations that collectively move metrics more than any fancy creative refresh.

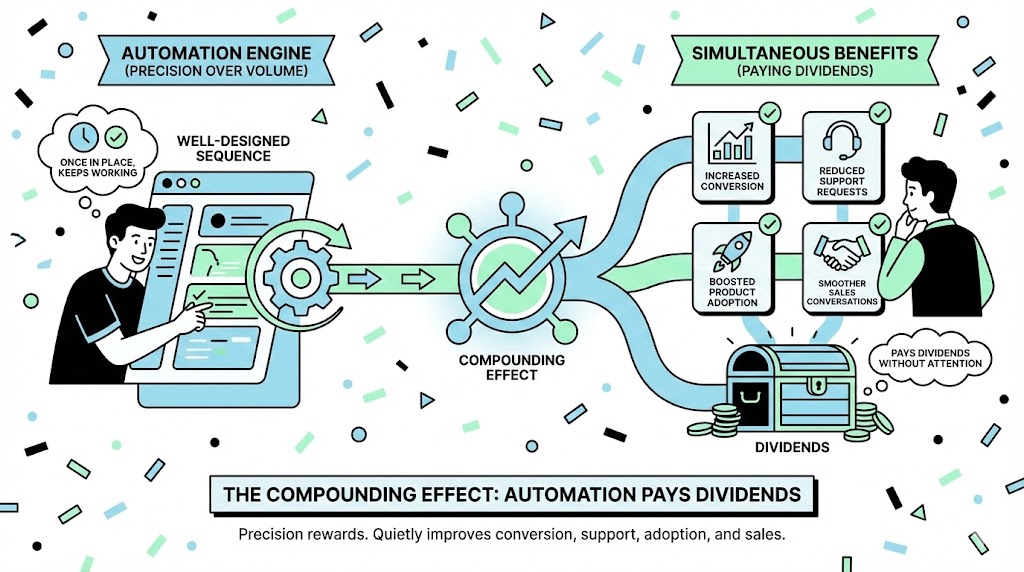

But the part I enjoy most is the compounding effect. A single well-designed sequence can quietly improve conversion, reduce support requests, boost product adoption, and make sales conversations smoother — all at the same time. It's one of the few marketing channels that rewards precision more than volume. Once the automation is in place, it keeps paying dividends without asking for more attention.

I think that’s why I continue to find email interesting. Behind every metric is a person trying to make a decision. Behind every workflow is a company trying to create clarity. And behind every incremental improvement is a long chain of thoughtful adjustments — segmentation, copy, timing, triggers, integrations, scoring, routing — all working together to create a moment that feels simple to the user.

Email may never look glamorous, but when it’s done well, it’s one of the most quietly transformative parts of the funnel. And the more complex the product, the more valuable that simplicity becomes.