I joined a project focused on acquiring new customers through an existing payment flow. Our import and export customers were already using the platform to pay their suppliers. From the supplier’s perspective, the experience was simple. A payment was sent, an email arrived, they clicked a link, chose how to receive funds, and the transaction was completed.

For many of these suppliers, that payment email was their first real interaction with our product.

Early on, I started asking a basic question. If suppliers were already experiencing the product through a real transaction, could that moment lead to adoption in a way that felt natural rather than forced?

The answer was not obvious. These suppliers were not traditional leads. They did not come through marketing channels, they had not opted into communications, and they had not asked to speak with sales. Their introduction to the product came through an existing business relationship, one where trust already existed and could easily be damaged if we pushed too aggressively.

That tension shaped how I approached the lifecycle design.

Defining the Real Success Signal

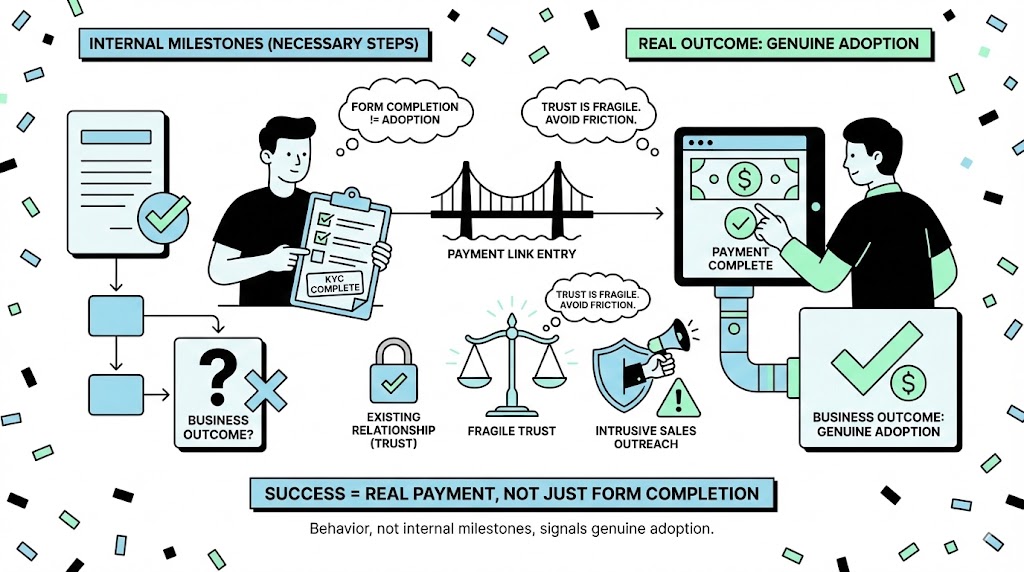

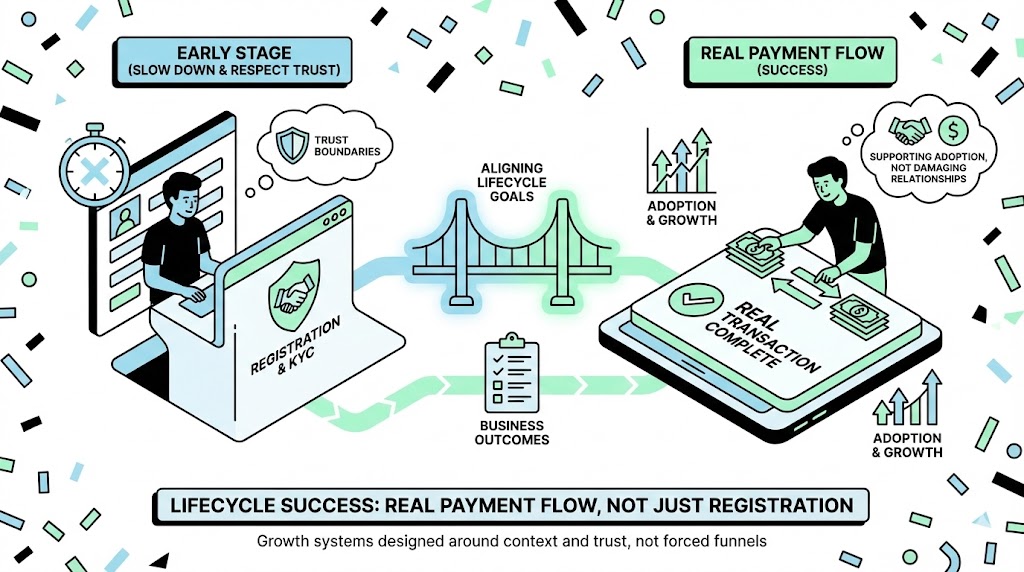

From the beginning, it was important to be clear about what success actually meant. Internal milestones like registration or KYC completion were necessary steps, but they were not the outcome the business ultimately cared about.

What mattered was whether a supplier completed a real payment on the platform after completing KYC. That behavior, not form completion, was the signal that indicated genuine adoption.

Because these users entered through a payment link rather than direct acquisition, their mindset was different. They were there to receive or make a payment without friction. The advantage was that trust did not start at zero. One side of their existing business relationship was already using the product, which reduced unfamiliarity. At the same time, that trust was fragile. Any interaction that felt intrusive, especially early sales outreach, risked damaging not only the new user relationship but also the relationship with the existing customer who introduced them.

Recognizing that risk early influenced every downstream decision.

Designing for Learning Before Commitment

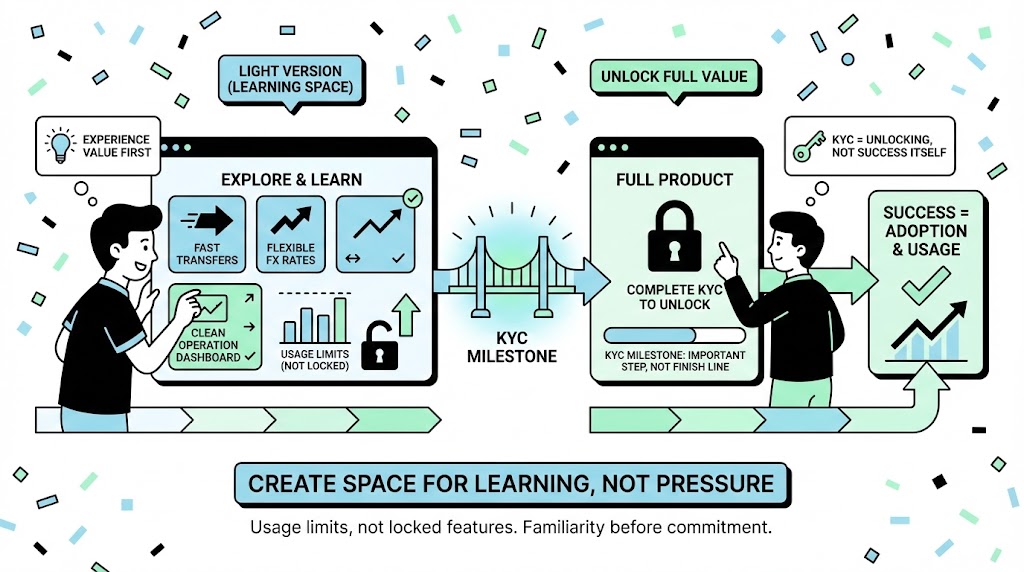

One of the first design choices we made was to introduce a light version of the product for newly referred suppliers. Instead of locking features, we used usage limits. The goal was not to restrict value, but to create space for learning.

Users could explore the interface, understand the workflow, and experience the speed and reliability of payments without being forced into an immediate commitment. Key capabilities such as fast transfers, flexible FX rates, and a clean operational dashboard were visible early, even if volumes were capped.

At this stage, the lifecycle focused on familiarity rather than pressure. Messaging was educational rather than transactional. We wanted users to understand what the product could do for them before asking them to do anything in return. KYC was positioned as a step toward unlocking full value, not as a finish line. Completing KYC was an important milestone, but it was never treated as success by itself.

Making a Deliberate Decision to Delay Sales

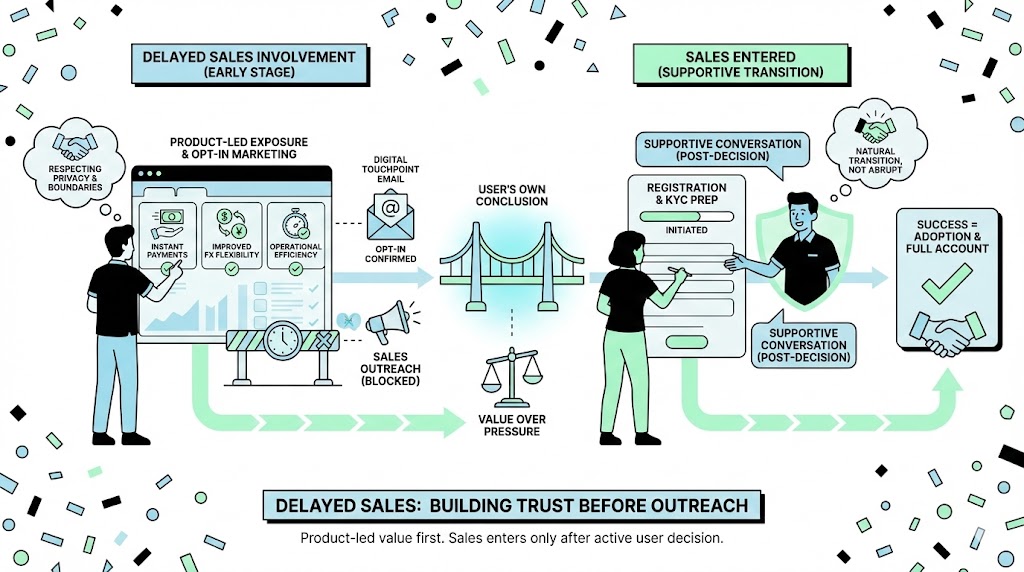

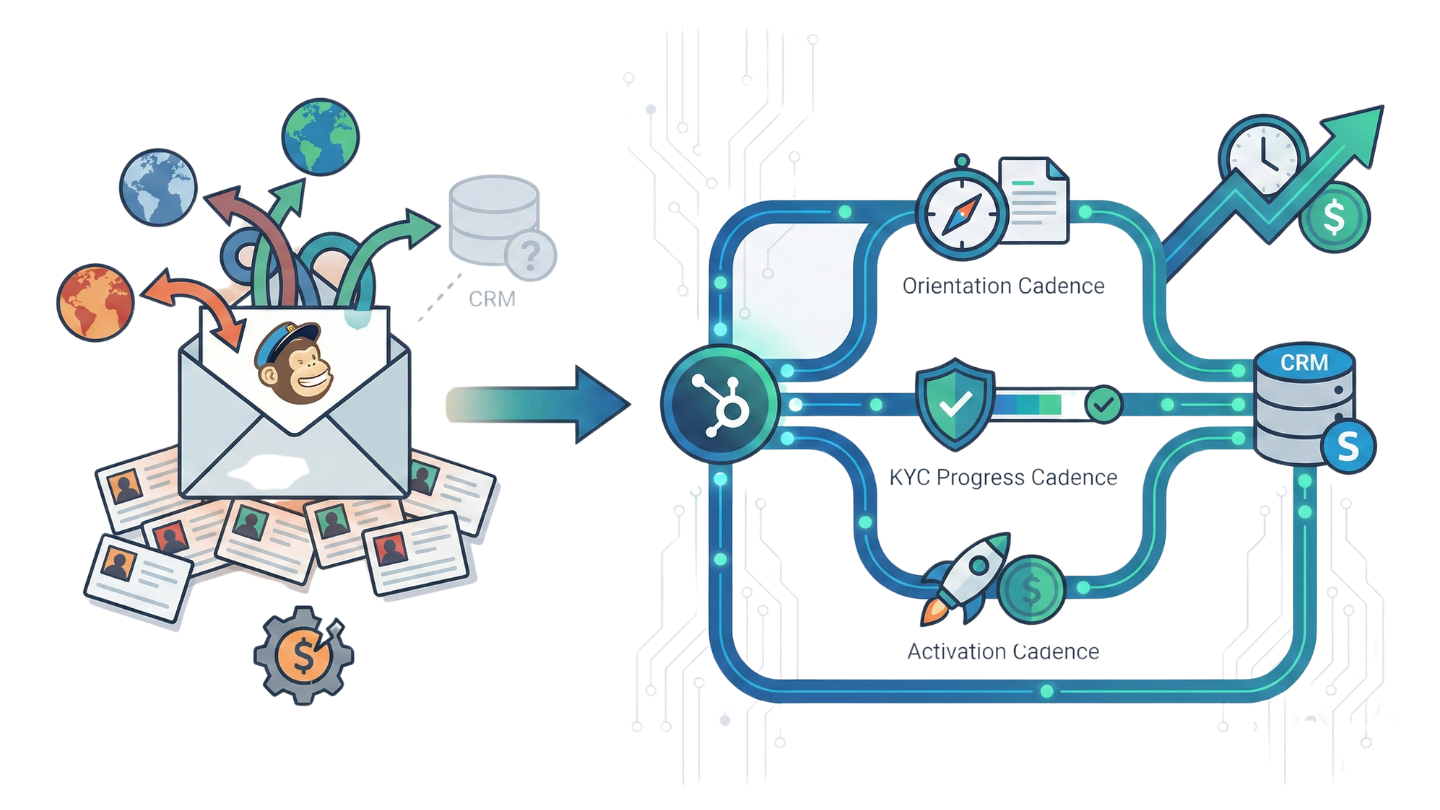

One of the more important decisions in this project was to intentionally delay sales involvement.

This was not a theoretical choice. Existing customers explicitly told us they were uncomfortable with sales reaching out to their suppliers too early. Concerns around privacy, relationship boundaries, and control were clear. Respecting those concerns mattered more than accelerating outreach.

As a result, early-stage engagement relied on product-led exposure, retargeted digital touchpoints, and opt-in marketing communications. Users only received marketing emails after explicitly opting in, and messaging focused on reinforcing practical value rather than pushing conversion. Instant payments, improved FX flexibility, and operational efficiency were presented as everyday benefits, not sales hooks.

The goal was to allow users to reach their own conclusion that moving forward made sense.

Sales entered the picture only after users made an active decision to move toward a full account. Once a user initiated registration and prepared for KYC, the context changed. At that point, a sales conversation felt supportive rather than intrusive. The lifecycle was designed to make that transition feel natural, not abrupt.

Protecting Sales Time Through Lifecycle Design

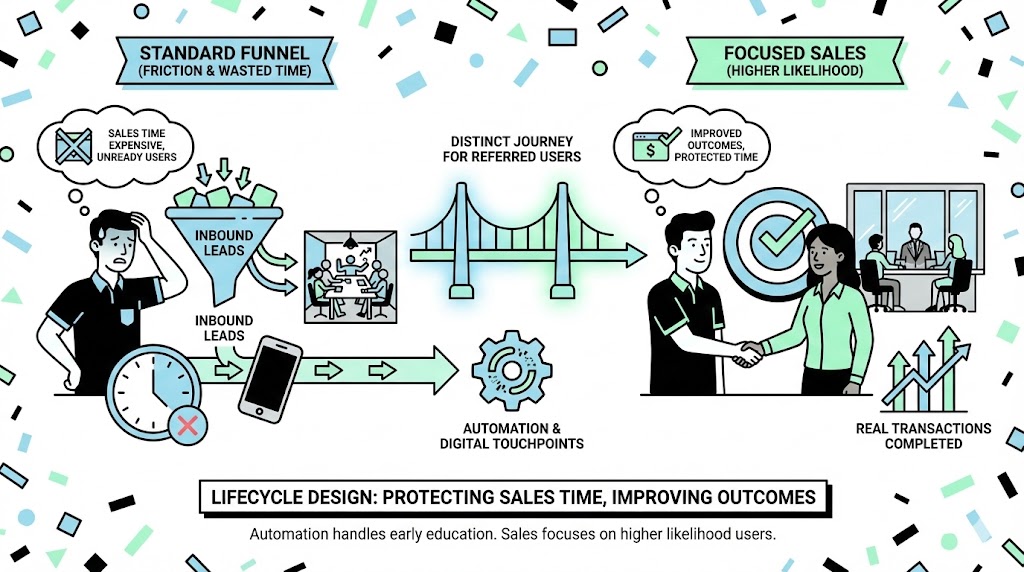

This approach also aligned with internal realities. Sales time is expensive, and early-stage referred users are not always ready for a conversation. By allowing automation and digital touchpoints to handle early education and qualification, sales teams could focus their efforts on users with a higher likelihood of completing real transactions.

Framed this way, lifecycle design was not a barrier to sales. It was a way to protect their time and improve outcomes.

What made this system work was not any single tactic, but the discipline to treat supplier referrals as a distinct group. Their journey was fundamentally different from inbound leads, and forcing them into a standard funnel would have created friction for users, sales, and existing customers alike.

What This Project Reinforced for Me

Looking back, the success of this lifecycle was not measured by how quickly users registered or how fast KYC was completed. It was measured by whether the platform became part of a real payment flow.

By slowing down early stages, respecting trust boundaries, and aligning lifecycle goals with actual business outcomes, we were able to support adoption without damaging relationships. Every step in the lifecycle existed to support that moment when a real transaction happened.

This project reinforced a pattern I have seen repeatedly in B2B fintech. Growth systems work best when they are designed around context and trust, not when users are forced into a funnel that was built for a different audience.