Creating a marketing tech-stack, process & automated workflow that supports long-cycle enterprise partnerships across banking, aggregators, and global channel partners

So the foundation of the ABM strategy began with building a standalone enterprise-facing materials which separate from the SMB experience and designed around the priorities of high-value partners. New site, new deck, new adcopy, new processes.

Everything from tone to structure to proof points was reworked to match enterprise expectations, creating a digital presence tailored specifically to the audience BD was engaging. To ensure consistency between what prospects saw online and what BD presented in person, we collaborated with design, product marketing, and content teams to create a brand new website and a modular enterprise pitch deck.

The deck mirrored the website’s narrative structure: a core company story, a flexible middle section tailored to different verticals, and a BD-personalized closing layer. This modularity allowed BD leaders to mix and match content depending on whether they were speaking to a bank, an accounting firm, an aggregator, or a channel partner, while still ensuring that the overarching message remained consistent and enterprise-grade.

A successful ABM strategy required tight alignment across teams who typically operated separately. BD guided vertical focus, deal patterns, and the nuances of partner expectations.

Product marketing shaped the technical narrative around API integration, compliance readiness, and infrastructure reliability. Design ensured that every element. From website to deck to ABM creatives—reflected a consistent visual and narrative identity.

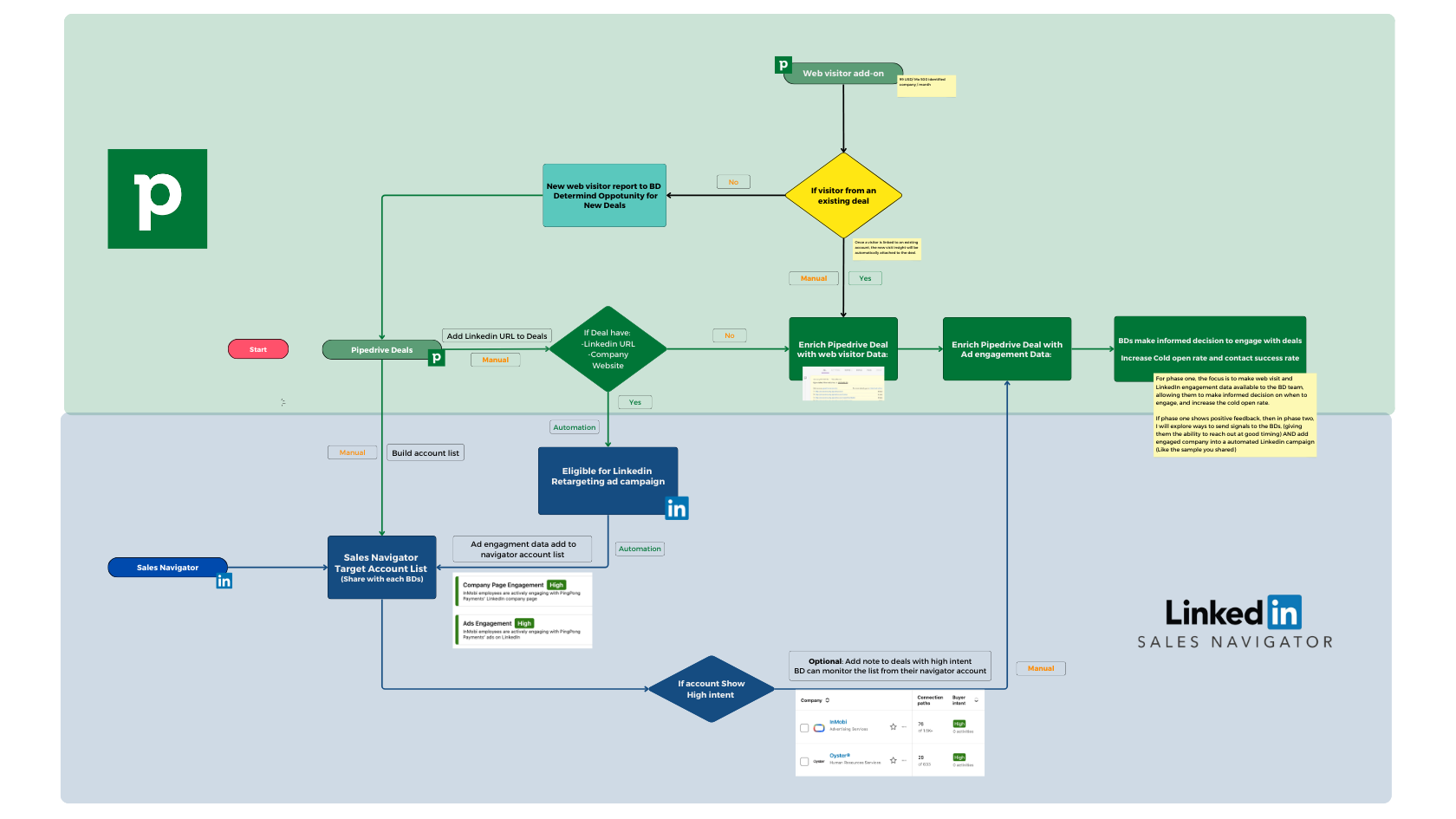

Engineering supported the integration between Webflow, Pipedrive, and ZoomInfo, creating a feedback system BD could depend on.The collaboration created a unified model where BD’s relationship expertise and marketing’s system design worked in concert.

Instead of BD improvising materials or messaging, every touchpoint aligned with a broader architecture designed specifically for enterprise credibility.