Additional Insight from Campaign Result

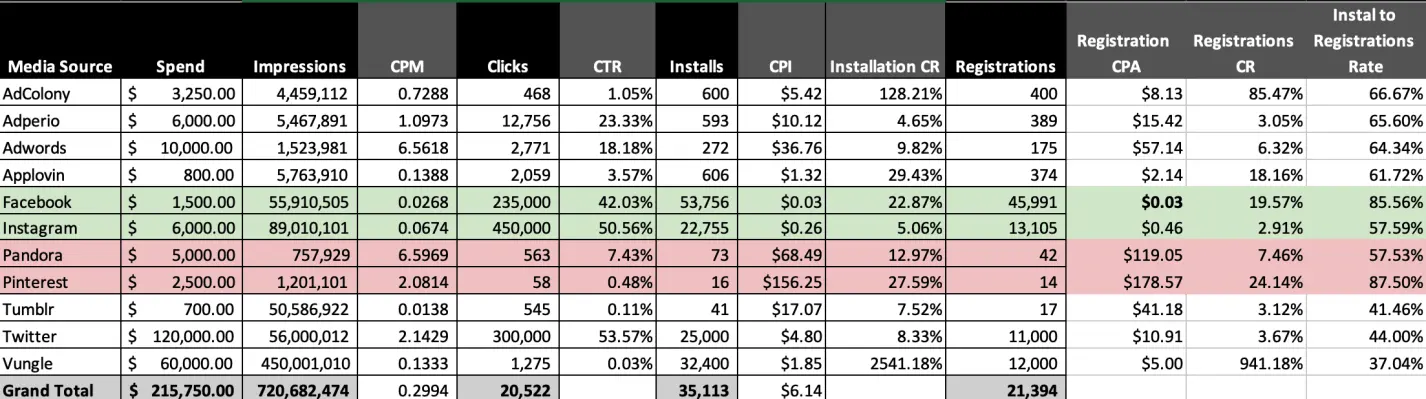

1. Facebook: Tons of impression, incredibly low cost per registration, as well as lots of room to scale the campaign. Based on the given data, the Facebook is the best traffic source to invest in.

2 Instgram: The second-best placement to run CPA campaign.

3 Vungle: The campaign produces some very questionable data, I assume the platform doesn't track campaign clicks very precisely. At this level of CPA, I would not consider continuing any further testing.

4 Adwords: Google Adword is not a display traffic source, so comparing CPA is not very relavent. Adword may not able to produce a satisfactory CPA campaign, but it can be a useful weapon to not allow competitors getting all the search volume for cheap (ie: outranking share bidding strategy)

5 Pandora: Horrible CPA on both traffic sources. Giving nearly no room to optimize any further

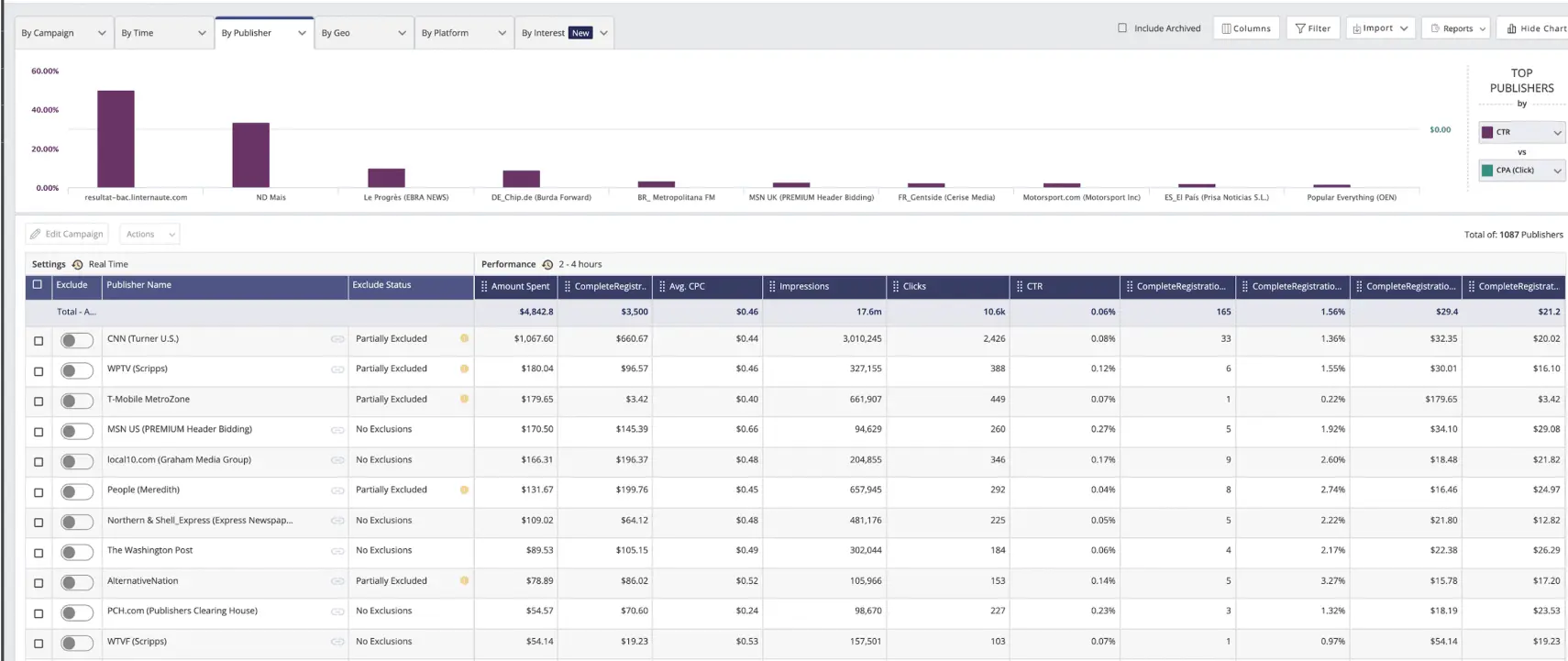

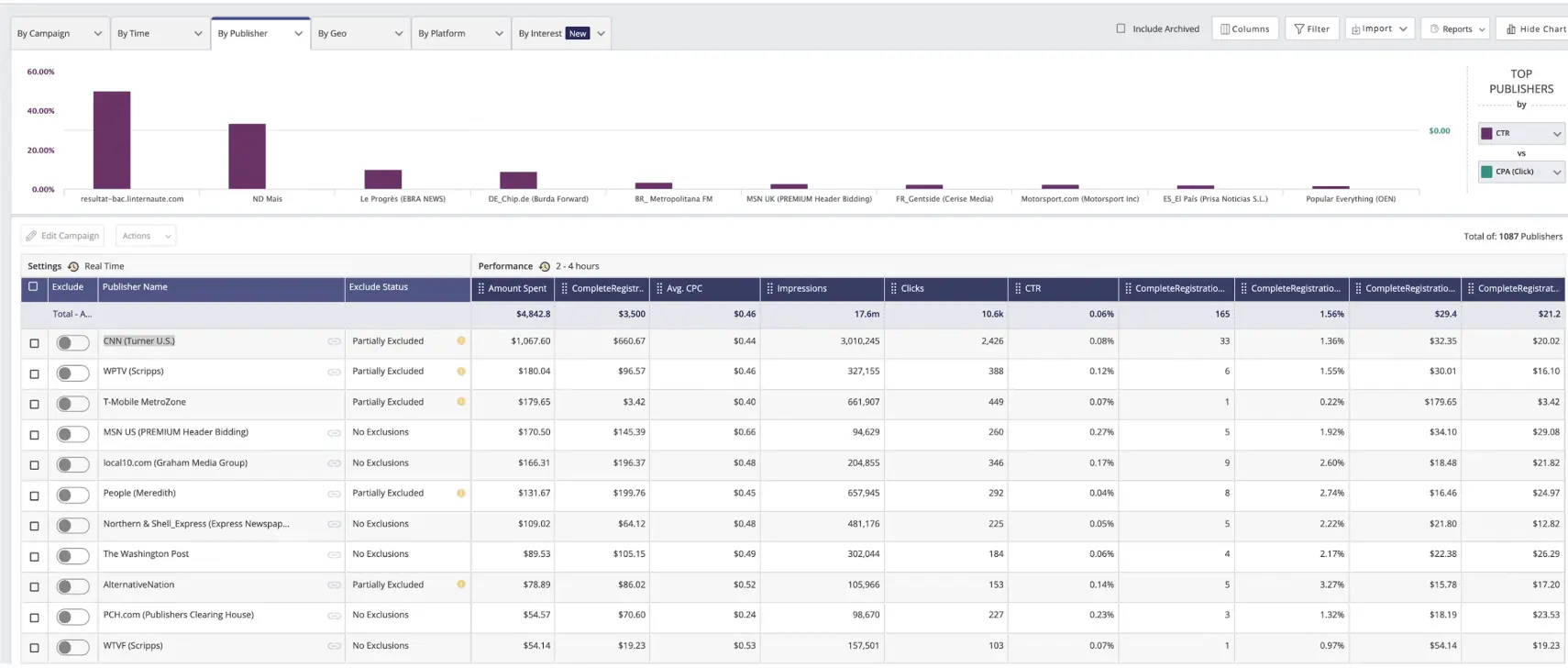

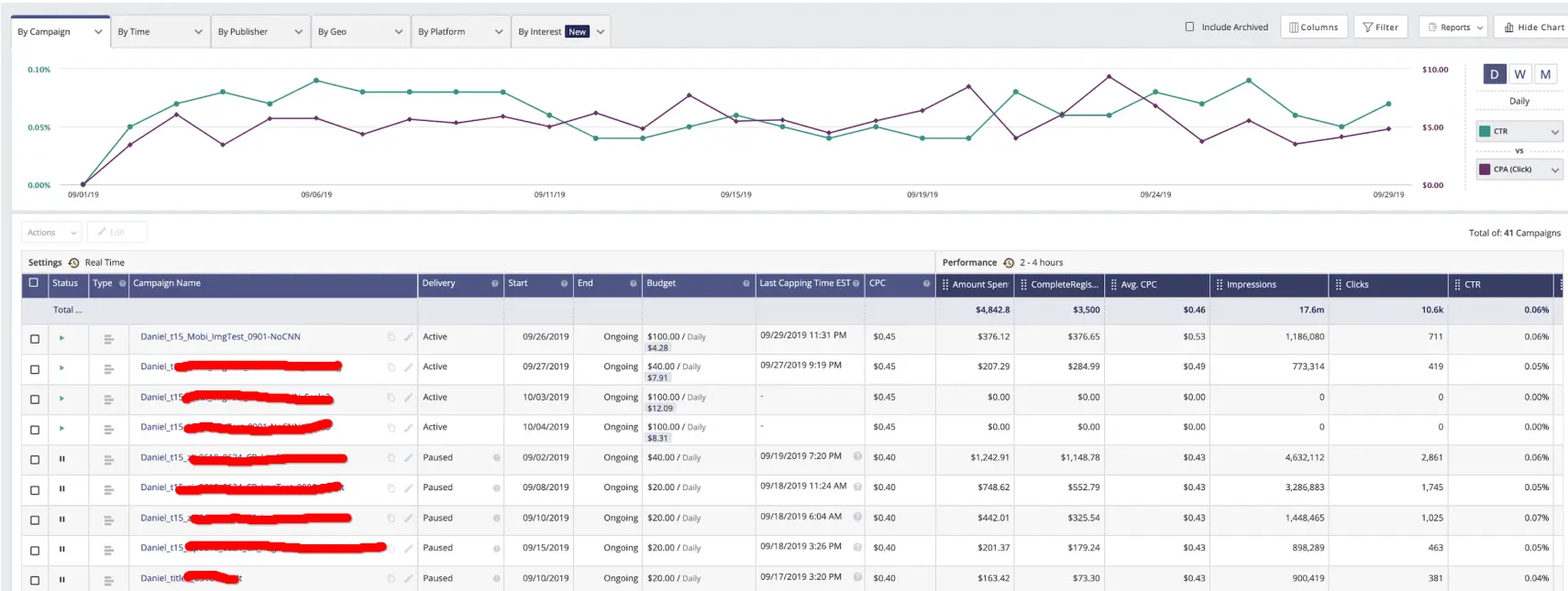

Based on the campaign performance data, it is clear that the Facebook platform (including ins) produces favorable CPA and scalable campaigns. Applovin does not have lots of campaign data but it shows the potential to optimize. Exclude all other traffic sources. I will heavily invest campaign budget in Facebook platform including instagram (total 90%). At the same time, allocating some budget on testing new traffic source as well as Applovin (total 10%).